You Can Make IRS Tax Payments Online

Paper Payments are Going Away - Make Payments Directly in the IRS Tool

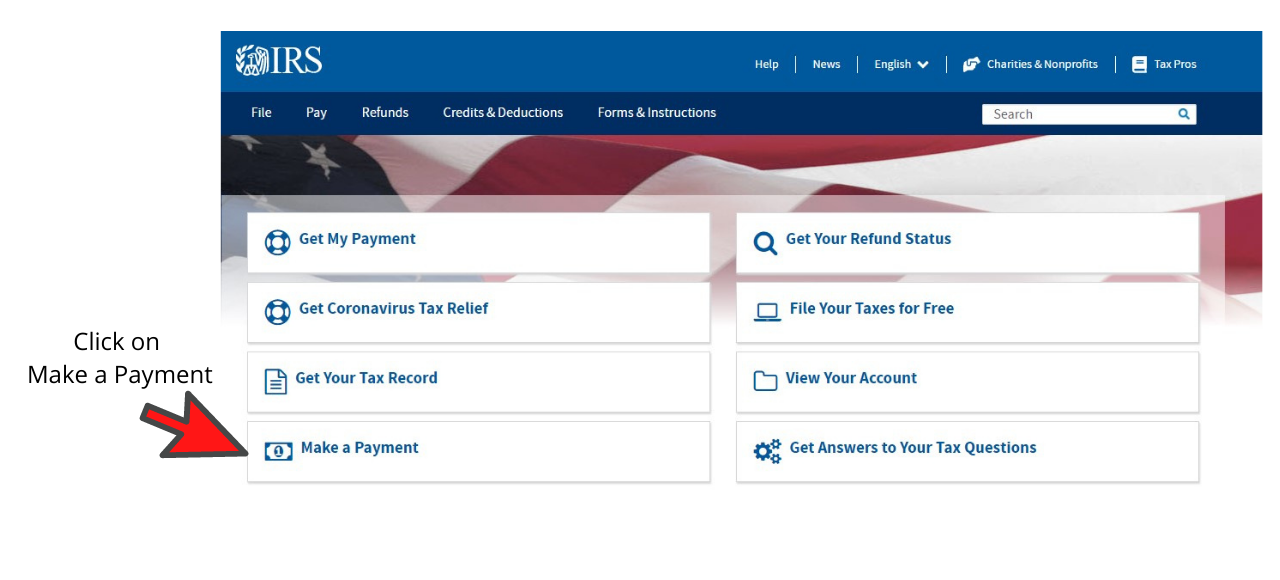

Use the IRS.gov Payment Tool

To make tax payments to the IRS directly, go to: https://www.irs.gov/

On the screen – choose “Make a Payment”

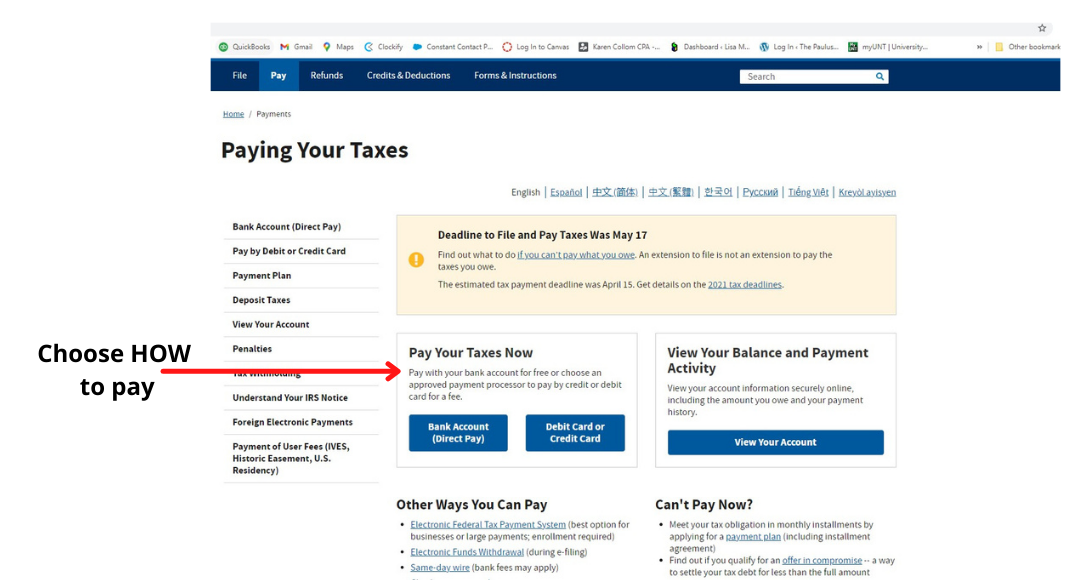

That will take you to the “Paying Your Taxes” screen. Choose your method of payment.

Please be aware that while there are no fees associated with Direct Pay(Bank Pay), there are fees for payments by Debit or Credit

Paying By Direct Pay

(Bank Account)

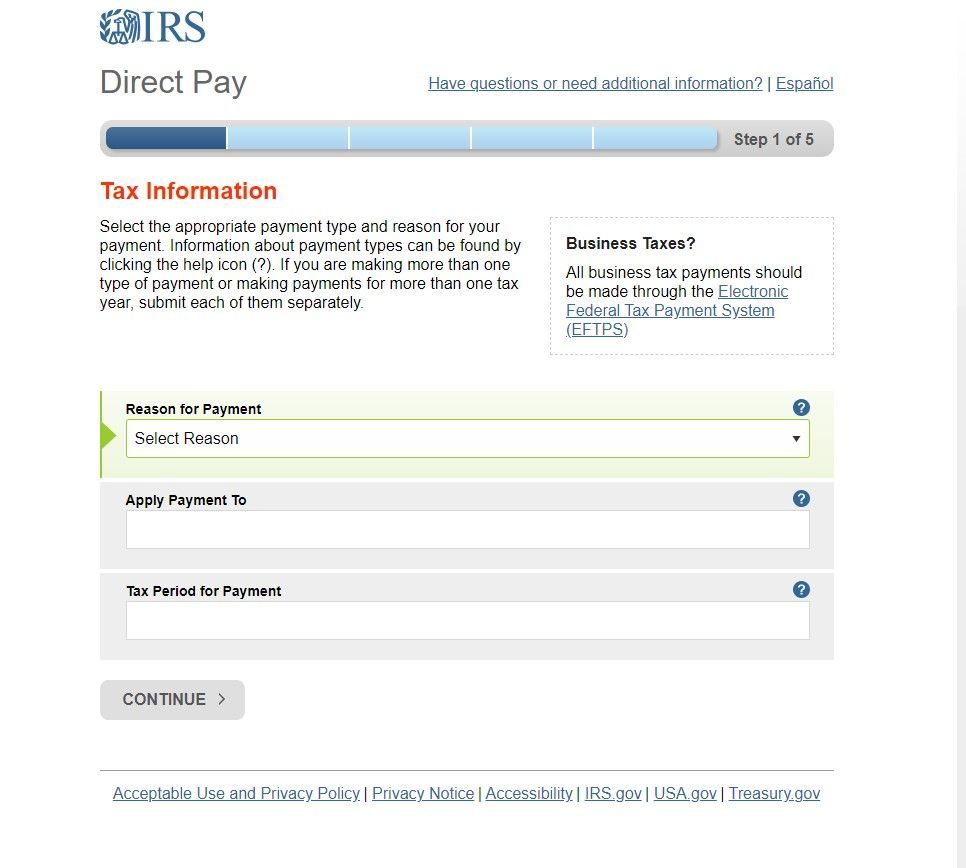

If you choose Bank Account (Direct Pay), it will take you to the following page.

If you are a sole proprietor or paying personal tax payments, Do NOT click on the box that says “Business Taxes?” in the upper right of the screen.

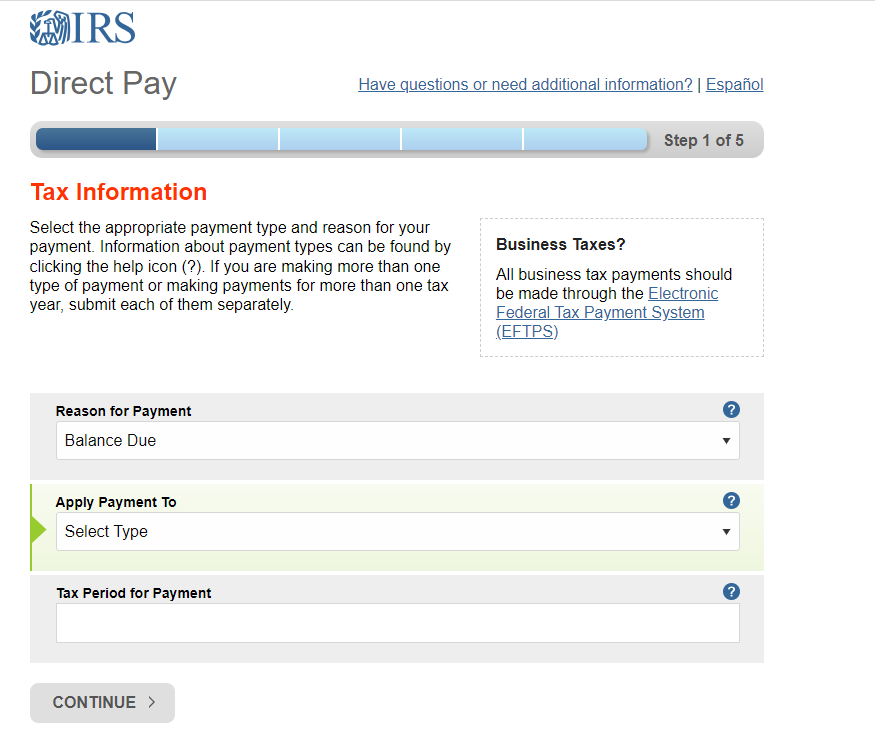

Choose the reason for your payment in the drop-down box.

Then choose what you want the payment applied to in the next drop down.

Then choose the tax period pertaining to the payment and hit continue.

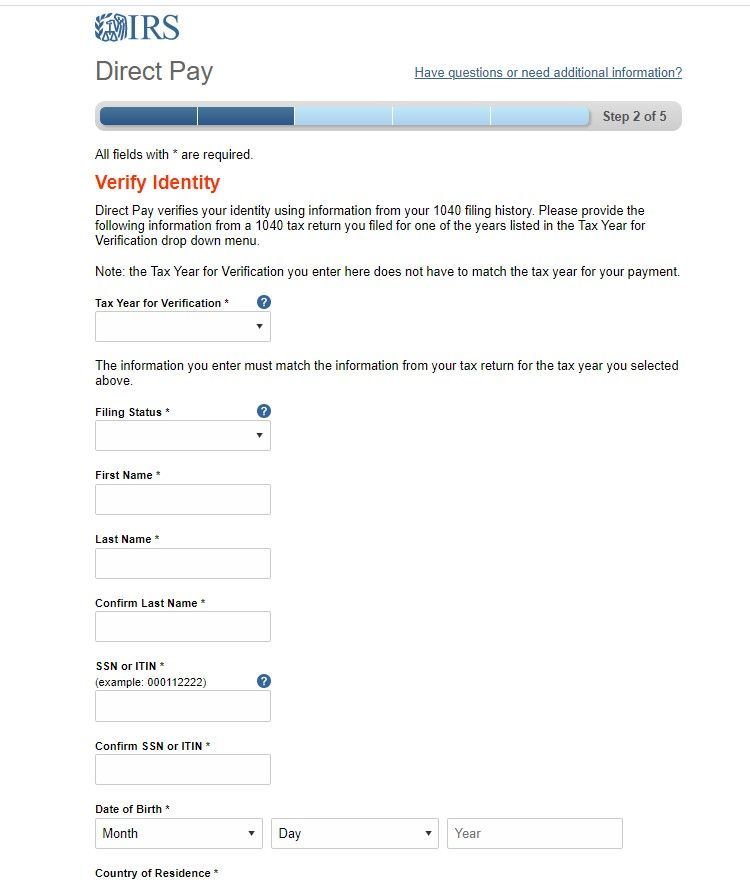

It will take you to an identity verification page. Input your information.

It will take you to an identity verification page. Input your information.

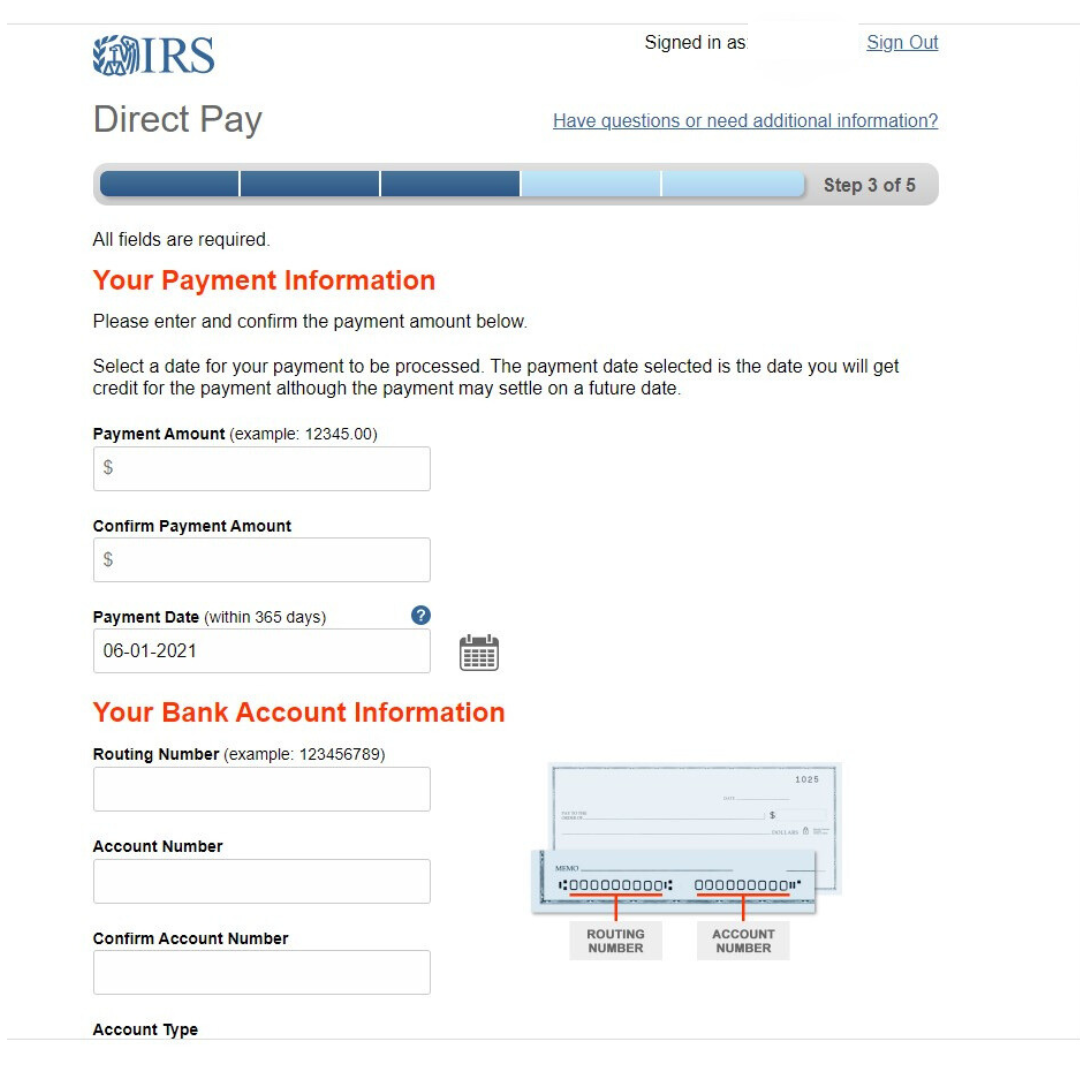

After you input your information, it will then take you to the payment page.

Enter your bank information and click submit.

Paying By Debit Card or Credit Card

If you are paying by Debit or Credit, click on the “Debit Card or Credit Card” button. There are fees associated with payments by Debit or Credit Card. You will be taken to the screen below.

Choose the payment processor that offers you the best fees for your card type and payment amount. Click “Make Payment” and follow the processor’s steps to complete the transaction.

Learn More at the Barklee Financial Group