2023 Business Meals & Entertainment Expense - IRS Deduction

The IRS Updates the 2023 Meals & Expense Deduction

As part of the Consolidated Appropriations Act signed into law on December 27, 2020, the deductibility of meals is changing. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022.

This applies to filing your taxes in 2023.

But for purchases made in 2023 onwards, the rules revert back to how they were defined in theTax Cuts and Jobs Act. This means purchases at restaurants are no longer 100% deductible.

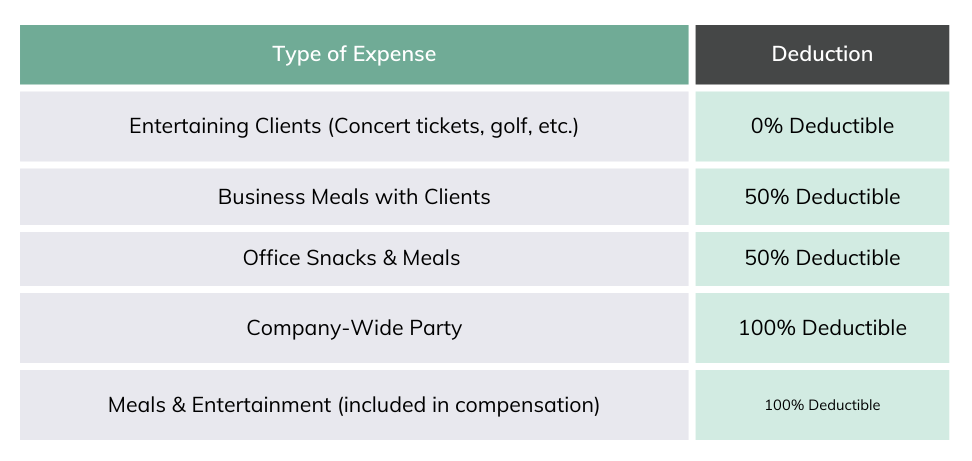

Here’s a breakdown of meal deductions using examples:

Fully Deductible Meals & Entertainment

Common examples of 100% deductible meals and entertainment expenses:

- A company-wide holiday party

- Food and drinks provided free of charge for the public

- Food included as taxable compensation to employees and included on the W-2

Common examples of 50% deductible expenses:

- A meal with a client where work is discussed (that isn’t lavish)

- Employee meals at a conference, above and beyond the ticket price

- Employee meals while traveling (here’s how the IRS defines “travel”)

- Treating a few employees to a meal (but if it’s at least half of all employees, it’s 100 percent deductible)

- Food for a board meeting

Learn More at the Barklee Financial Group