IRS Improves Services to Taxpayers with Digital Authorizations

Agency also Launches New Tax Pro Account

Taxpayer Digital Authorizations

The Internal Revenue Service has launched a new feature that will give taxpayers digital control over who can represent them or view their tax records.

The new feature is one of many recent enhancements to the Online Account for individuals. It will allow individual taxpayers to authorize their tax practitioner to represent them before the IRS with a Power of Attorney (POA) and to view their tax accounts with a Tax Information Authorizations (TIA).

Set up or View Your Online Account with the IRS

Tax Pro Launch

Effective July 19, 2021, tax professionals can go to the new Tax Pro Account on IRS.gov to digitally initiate POAs and TIAs. These digital authorization requests are simpler versions of Forms 2848 and 8821.

Once completed and submitted by the tax professional, the authorization requests will appear in the taxpayers’ Online Account for their review, approval or rejection and electronic signature. Because the taxpayers’ identities already are verified at the time of login, they simply check a box as their signature and submit the authorization request to the IRS.

Benefits of Taxpayer Digital Authorization and Tax Pro

- No Manual Processing - The completed digital authorization, if accurate, will go directly to the Centralized Authorization File (CAF) database and will not require manual processing.

- Real-time Authorization - Most requests will be immediately recorded and appear on the list of approved authorizations in the taxpayer’s Online Account and the tax professional’s Tax Pro Account. Some authorizations may take up to 48 hours. Tax professionals may then go to e-Services Transcript Delivery Service to see the taxpayer’s records.

- Faster Streamlined Process - Allows the IRS to reduce its current CAF inventory and focus on authorization requests that required IRS Personnel to handle - such as fax, mail or the

Submit Forms 2848 and 8821 Online.

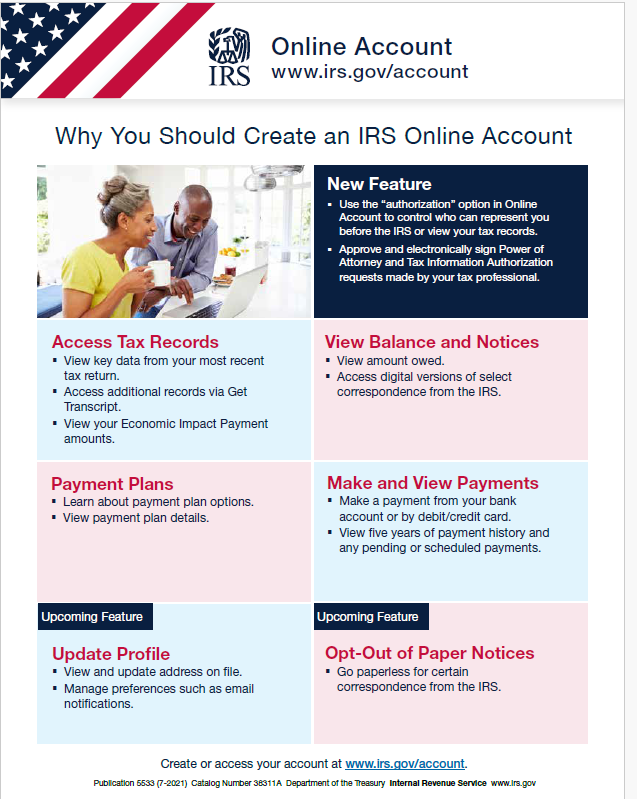

Why Create an Online Account with the IRS?

Right click on the button below to download and save the file that the IRS created discussing the importance of creating an IRS Online Account. (see image)

Learn More at the Barklee Financial Group